This month our Not Just a Mom group is looking at some money saving tips. I'll be the first one to admit I might not be the person to ask! I used to be really, really good at saving money and scouting out deals because I had to. We've always managed to make living on one income work but there were years when I had to really stretch our budge to make it work.

Thankfully we are now much more financial stable... but that has led to definite overspending now.

However, here are some things I definitely remember doing when we were pinching pennies-- honestly they all pretty much boil to down 2 things: know the difference between want and need, and always pay cash.

I was ruthless about our budget when things were tight and we would never or hardly ever eat out, get take out on a whim (often eating pasta and sauce as a last minute quick meal), of do much of anything that required money without asking how we were going to pay for it. If we didn't have an answer I didn't let us do it. I'm not going to lie; it wasn't easy, it wasn't always fun, it definitely caused an argument or two along the way, but in the end it was totally worth it.

Other than our mortgage we never "just made the payments" ; often deciding to go without until we could afford that new appliance or that "new to us" car, etc. (But planning enough in advance that we were rarely left in the lurch).

1.Since groceries have always been one of our largest bills I'll start there.

- Plan a menu around sale items

- Stretch the meat portion of a meal into 2 whenever possible. If I was serving a roasted chicken you can bet chicken soup was also on the menu.

- Learn when foods go on (major) sale and stock up. When whole turkeys were only 59 cents a pound at Thanksgiving I often bought 2-- one for Thanksgiving and one for another meal (which really a whole turkey for us could easily stretch to 3 meals with leftovers!).

- Soups, stews, and casseroles are very budget friendly.

- Since meat was always the most expensive part of our bill I would plan a meatless meal once a week. A healthy choice for our bodies and our wallet!

- Don't shop for convenience-- prepackaged foods cost more money and are often easy enough to prepare yourself if you set aside a day (once or twice a month) for prep work.

- I used to really limit or not even buy snacks. You'd be surprised how many times my boys wanted a snack because they were "starving" but if I offered something healthy like an apple suddenly they weren't hungry anymore. This is that mindless snacking we all could learn to do without.

- I used to make a list and ONLY bring cash-- that way I could not add those eye catching extras we didn't really need.

|

| One of the boys' favorite meatless meals |

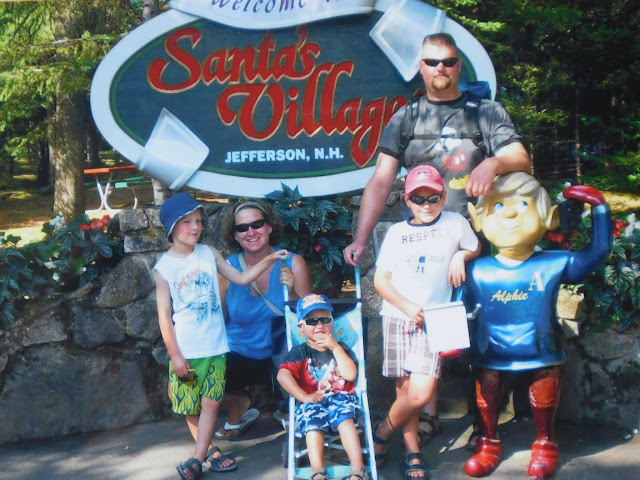

2. After food I often prioritized vacations since I love to travel:

- Travel in the off season

- Look for rentals that have kitchens so you don't need to eat out

- Look for coupons and freebie deals for family fun (often local libraries have wonderful and free programs)

- Be as flexible as you can. We once got 1/2 priced flights by flying a week earlier!

- We would save up money all year long for our vacation and I was ruthless about sticking to our budget; even going to far as to deliver a stack of cash to our travel agent one year for a big Disney vacation we'd been squirreling money away for for years.

- Some years we just didn't take a vacation at all.

3. Household/ leisure activities with the kids:

- We would buy memberships once a year to a zoo or museum-- most of them had reciprocal memberships to others in the area and we made sure to visit often and visit anything else that we could while it was free.

- We asked for experience/ membership/ gift certificates from family members at holiday or birthday times.

- While we have and use credit cards I always treated them like debit cards and paid them off each month; sometimes calling to check weekly to make sure the balances weren't getting too high (and if they did I locked them up in our safe so we wouldn't use them again until the bill was paid).

- We never paid "extra" fees-- not on our credit cards, not on our insurance, etc.; even if it meant paying in full in one chunk in the long run if it saved us money we always tried to find a way to make it work.

- We used coupons for everything we could find and learned how to do a lot of things ourselves; sweat equity often takes longer but is much cheaper.

- As soon as we built our house and had a mortgage to pay I always tried to pay an extra 10% each month on the principle to pay it down as soon as possible; knowing that the extra penny pitching in the early years would lead us to pay off that mortgage sooner and have more money in hand at the end.

|

| We visited so many local museums and zoos so often we knew employees by name and anticipated changing exhibits with much enthusiasm! |

|

| Our aquarium membership had a deal with the local science museum |

|

| We made sure to visit the science museum whenever an "aquarium members visit free day" popped up! |

|

| exploring nature is always free (or just requires a small parking fee) so we did A LOT of that |

|

| Homeschool days or group events often offer real cheap admission to places we might never have gone otherwise. |

I hope you'll join us next month when we look at our favorite comfort foods.

Linking up with: Fine/Whatever,

Love the planning here ☺️

ReplyDeleteBlessings, Jennifer

Thank you!

DeleteGreat discipline on your part and great tips! This was interesting to read and I found myself nodding a lot as I recalled doing many of the same things as you during our lean years right after I quit my good paying job to stay home with the kids. It was worth it but it meant denying ourselves much of what we saw our friends and people around us doing and buying. We stayed the course and now we are completely debt free. I still have many of the same habits as I did we HAD to spend little. Now that we don´t, I still want to be a good steward of our money and have more to save, give away, etc.

ReplyDeleteGreat discipline on your part and great tips! This was interesting to read and I found myself nodding a lot as I recalled doing many of the same things as you during our lean years right after I quit my good paying job to stay home with the kids. It was worth it but it meant denying ourselves much of what we saw our friends and people around us doing and buying. We stayed the course and now we are completely debt free. I still have many of the same habits as I did we HAD to spend little. Now that we don´t, I still want to be a good steward of our money and have more to save, give away, etc.

ReplyDeleteReposting with my name, lol. Don´t know why the above posted as anonymous!! Have a great Monday :).

LOL! I don't know it's posted as anonymous sometimes either. We have been debt free for several years now and I love it but with needing (okay that MIGHT be a want) more cars for more drivers/ college tuition/ etc. our expenses have definitely made it much harder to keep those belt tightening practices in place. Not a whole lot of areas to save with those sorts of things. BUT I am so happy we can afford to help out.

DeleteVery down to earth, lI ove this article! And what a great life you have lived so far...

ReplyDeleteThank you!

DeleteSuch awesome tips Joanne. We always have quick pasta dinners when things are tight here too!

ReplyDeleteAw, thanks!

DeleteWonderful ideas - thanks for sharing! #MMBC

ReplyDeleteThank you!

DeleteYou have a great take on this topic and amazing discipline. Thanks for putting this together!

ReplyDeleteI have always been a saver and quite frugal... but I've found that both my husband and I have rubbed off on one another where we he now thinks before he spends and I've learned that buying myself a good pair or pants or shoes isn't going to break us. Though I think he might argue I have learned that lesson a little too well! LOL

DeleteThese are all great tips and I agree with all of them. You sound like me, as I remember living (and still do some of these things) just like this. As our society continues to go "cashless", paying with cash gets harder.

ReplyDeleteSo far I really haven't run into anywhere that wont take my cash (in fact many of our small businesses have flat out told me they still prefer it since they don't have to pay that % to the credit card companies) but I have heard that there is a real push to go cashless.

DeleteI agree on not eating out while traveling, although that makes it more fun! Reciprocal memberships are great too.

ReplyDeleteIt sure does! Though I find more and more I can only eat out in small doses as my body is just not used to all the heavy and greasy foods anymore and more often than not I just feel sick and icky.

DeleteYou have some really great tips here, I do many of these nowadays and wish I had much sooner.

ReplyDeleteThank you!

DeleteI will echo the point on prepackaged foods! It’s not that hard to cut up some fruit and vegetables, I’m always amazed what people spend extra money on for convenience.

ReplyDeleteSarah @Toronto SAM

Me too!

DeleteYou shared some great tips. We have been doing vacations where we stay at have kitchens because it makes such a big difference.

ReplyDeleteThank you!

DeleteI need to keep pasta and sauce on hand as an easy meal on nights when no one feels like cooking. Dave and I lived for years on one salary and it was doable but definitely we made some sacrifices.

ReplyDeleteYes, I try to always have those few staples on hand.

DeleteFantastic advice!

ReplyDeleteMy dad always says to my brother and I do you want it or do you need it. It really works to know the difference.

If I see meat on offer at the shop or reduced I will buy it and pop it in the freezer. It comes in handy.

We freeze a lot of things; but definitely meat when it goes on sale.

DeleteGreat tips! My library card has saved me hundreds of dollars a year. Saves a lot of space in the apartment too :)

ReplyDeleteYes! Between me and my middle son (who is by far my most prolific reader of the bunch) save tons of money on books through our library. We often "rent" movies from them too saving on streaming costs as well.

DeleteExcellent tips, Joanne! My husband and I are both retired and have good savings because we lived all our lives following a budget and saving when we can. I still get a thrill of satisfaction by buying all my clothes on sale and using coupons and buying sale items at the grocery store.

ReplyDeleteMe too! I love seeing how much I can save and how small I can get that bill.

DeleteAll great tips, Joanne. I find that having a menu and paying cash are the real winners. You have to be very disciplined not to slip a few extras in your cart but having backups (like the pasta and sauce you mentioned) is really a lifesaver. When we were homeschooling, we always took advantage of free or low cost programs - early September was a great time to visit places as the rates were super cheap. They weren't busy because kids were back in school but it was too early in the year for teachers to have planned field trips.

ReplyDeleteYes! We often traveled in September and always took advantage of free summer admission to museums whenever they were offered. Early September was our favorite time to visit zoos, museum, and parks because we always had the places to ourselves.

Delete...we have been married for 55 years and have always been frugal. Living on less than we made, saving and investing. Our retirement is safe and secure. Always save for a rainy day!

ReplyDeleteThat is definitely my motto!

DeleteLove all the happy memories seen in the photos. Great times even when pennies were tight and budgets are smaller. Money does not necessarily buy happy memories:)

ReplyDeleteThank you and I agree 100%!

DeleteSo glad you have shared this with SSPS, thank you!

ReplyDeleteYou're welcome! Thank you so much for hosting.

DeleteThese are great tips! It's really true how the pre-packaged "easy" meals are much more expensive. I really love taking advantage of a freezer for saving extras or stocking up. Thanks for sharing this post at the Will Blog for Comments #10 linkup. Hope to see you again next week.

ReplyDeleteWe were thrilled when we were gifted a chest freezer and I could double any casserole we made and stick one in the freezer for an easy ready-made meal.

DeleteGreat tips and yes to not buying snacks! When my kids were little I never bought snacks and then later on when we could afford to splash out a bit more on our food budget, snacks became a permanent addition to the shopping list. Recently I stopped buying things like chips and dips. One, because my husband is trying to lose weight and having chips in the cupboard is way too tempting. Secondly the price for a bag of chips increased from $4.00 to around $7.00!

ReplyDeleteRuth@playworkeatrepeat

Yes, snacking is expensive nowadays for sure. It can be so hard not to buy any though because then when that craving hits I know we don't have anything! LOL

DeleteWow! You are fantastic at sticking to that budget and saving for priorities. These are great tips! We still ask for and give experiences for our kids as gifts. Sarah @ Sunshine & Books

ReplyDeleteThank you!

DeleteWe would pay our mortgage twice a month but only half of it at a time. That meant we actually paid 13 times a year so that helped decrease the number of years we had one. After a bit, I also added a few extra hundred each month to pay it off even earlier. Now, I use a credit card for everything and pay it off at the end of the month. That way, my debit card isn't compromised (happened once when we were on vacation), and I get extra points/dollars. But, I do make sure to pay it off. I never carry balances on any credit cards. Our grocery store, years ago, would take the ads from the other store in town. I would cut those out religiously and make sure they credited me the right amount. It all takes discipline, right?

ReplyDeletehttps://marshainthemiddle.com/

I don't even own a debit card (and we have always used our credit cards like they are debit cards and enjoy those cash back/ bonus points!). I loved when stores used to accept competitor's coupons or ads!

DeleteGreat tips! When I was 21 I had a year without work and really little money to spend. I often ate the same vegetables when they were cheap. But it was a good learning process.

ReplyDeleteOh I bet that definitely taught you to be frugal!

DeleteThese are really good tips, Joanne!

ReplyDeleteThank you!

DeleteI always think we should have learned more about budgeting in school because it makes life so much better!

ReplyDeleteXoxo

Jodie

Yes I think so too!

DeleteThe meatless pasta looks yummy! Lots of great tips and I agree with the others about discipline. Thanks so much for linking up at the #UnlimitedLinkParty 133. Pinned.

ReplyDeleteThank you!

DeleteWe love to travel in the off season too-- not only is it cheaper, but it's less crowded and more enjoyable!

ReplyDeleteYes! I am not one to enjoy crowds at all so even when we find that places operate on reduced hours or have limited things open (like the food places at the zoo, etc). we are more than happy to just go with the flow and be thankful that we often have these places to ourselves.

DeleteYou have some great suggestions! I'm thankful my kids are at the age where they understand the value in an experience or the idea of quality over quantity...it's made the holidays easier.

ReplyDeleteYes, I love that too.

Delete